Best Forex Pairs To Trade

All products and services featured are independently selected past WikiJob. When you lot register or buy through links on this folio, we may earn a commission.

67% of retail investor accounts lose coin when trading CFDs with this provider. You should consider whether you can afford to take the high take chances of losing your money.

In this article Skip to section

- What Are the Types of Currency Pair That You Can Merchandise?

- Majors

- Minors

- Crosses

- What Makes a Adept Currency Pair?

- What Time of Twenty-four hour period Will You Trade?

- Liquidity

- Price Stability

- Predictability

- The Top 10 Forex Currency Pairs

- 1. EUR/USD

- 2. GBP/USD

- three. USD/JPY

- four. AUD/USD

- 5. EUR/GBP

- 6. USD/CAD

- seven. USD/CHF

- 8. NZD/CHF

- 9. USD/CNY

- 10. USD/HKD

- Last Thoughts

Forex is past far the largest trading market, available 24 hours 5 days a week. Information technology is also the nearly volatile market and hence provides the opportunity for heftier profits.

A forex currency pair includes the U.s.a. dollar and/or other global currencies.

The first currency in the pairing, for case, the British pound in GBP/USD, is the base currency. The 2nd currency, the US dollar in the above example, is known as the quote currency.

More often than not, the base currency will exist the trader'southward domestic currency.

The cost of a forex currency pair is an expression of how much of the quote currency is needed to buy one unit of the base of operations currency.

For instance, EUR/GBP one.45 indicates that £1.45 is required to buy one Euro. A value of EUR/USD 1.89 means that $1.89 would buy one Euro.

For more information on investing in this marketplace, read The Best Ways to Learn More Well-nigh Forex Trading.

What Are the Types of Currency Pair That Yous Tin can Merchandise?

Forex currency pairs can exist divided into the post-obit categories:

Majors

Majors are mostly the nigh popular type of currency pair to trade. They volition always include the United states dollar and are generally the about liquid; that is, they provide the trader with the greatest ability to trade that pair on the forex market.

Majors take the highest liquidity of the three types of currency pair; however, the fact that these currencies are more often than not easier to research means that trading majors can be a crowded and therefore competitive marketplace.

Minors

Minors do not include the United states of america dollar but do include one of the other major global currencies (for case, the Euro).

They accept a lower level of liquidity than majors and at that place is generally less available data on these currencies.

Trading minor currency pairs is therefore a less competitive marketplace which traders may exist able to take advantage of.

Crosses

Crosses are any currency pairing that does not include the Usa dollar.

How is this different from a pocket-size?

A minor must include ane of the major currencies (for instance, the Euro), whereas a cross is made up of any non-US dollar currency.

Therefore, a pocket-sized is a type of cross.

For more on this topic, read What Are the Benefits of Forex Trading?

What Makes a Adept Currency Pair?

What factors should you consider when deciding which forex currency pair to choose?

What Time of Twenty-four hours Volition Yous Trade?

Will you trade during the twenty-four hours or at dark? This might not seem a relevant question until you consider the route of the trading day:

- Opening in Asia

- Moving adjacent to the Middle E

- So Europe and London

- Finally, New York and the Usa

This means that not all of these trading areas will be open continually or at the same time.

For instance, if you are a night trader in the Usa, the Middle East and Europe/London may be airtight and therefore your only option is the U.s.a. and Asia.

The time of 24-hour interval when y'all trade will decide which currency markets are bachelor to you lot.

Liquidity

This is generally the fundamental gene when deciding which currency pairs to trade. Equally a trader, y'all want to trade currency pairs that you can easily purchase and sell.

The exception to this rule is the trader who seeks to take advantage of the erratic functioning of less liquid currency pairs. This method is called scalping and involves taking small profits several times throughout the day.

For more on this topic, read Forex Scalping: A Strategy Guide.

Equally mentioned in the previous section, majors accept the highest liquidity, followed past minors and crosses.

Price Stability

The toll stability of a currency is intrinsically linked to the economical health of the nation or nations continued to that currency.

For instance, the US to the US dollar or the Great britain to the British pound.

When considering which currency pair to cull, you lot should factor in the probable economic scenario of those countries.

Predictability

In other words, how much historical data is available on a currency.

The benefit of trading major currency pairs or pairs involving any major global currency is the vast corporeality of data available to estimate how a currency is likely to perform.

Bottom global currencies, and particularly currencies that are newer to the forex market, volition carry less historical data and their performance will therefore be more difficult to predict.

Now that you know the factors that may affect your choice of forex currency pair, why not read Planning a Successful Long-Term Forex Strategy?

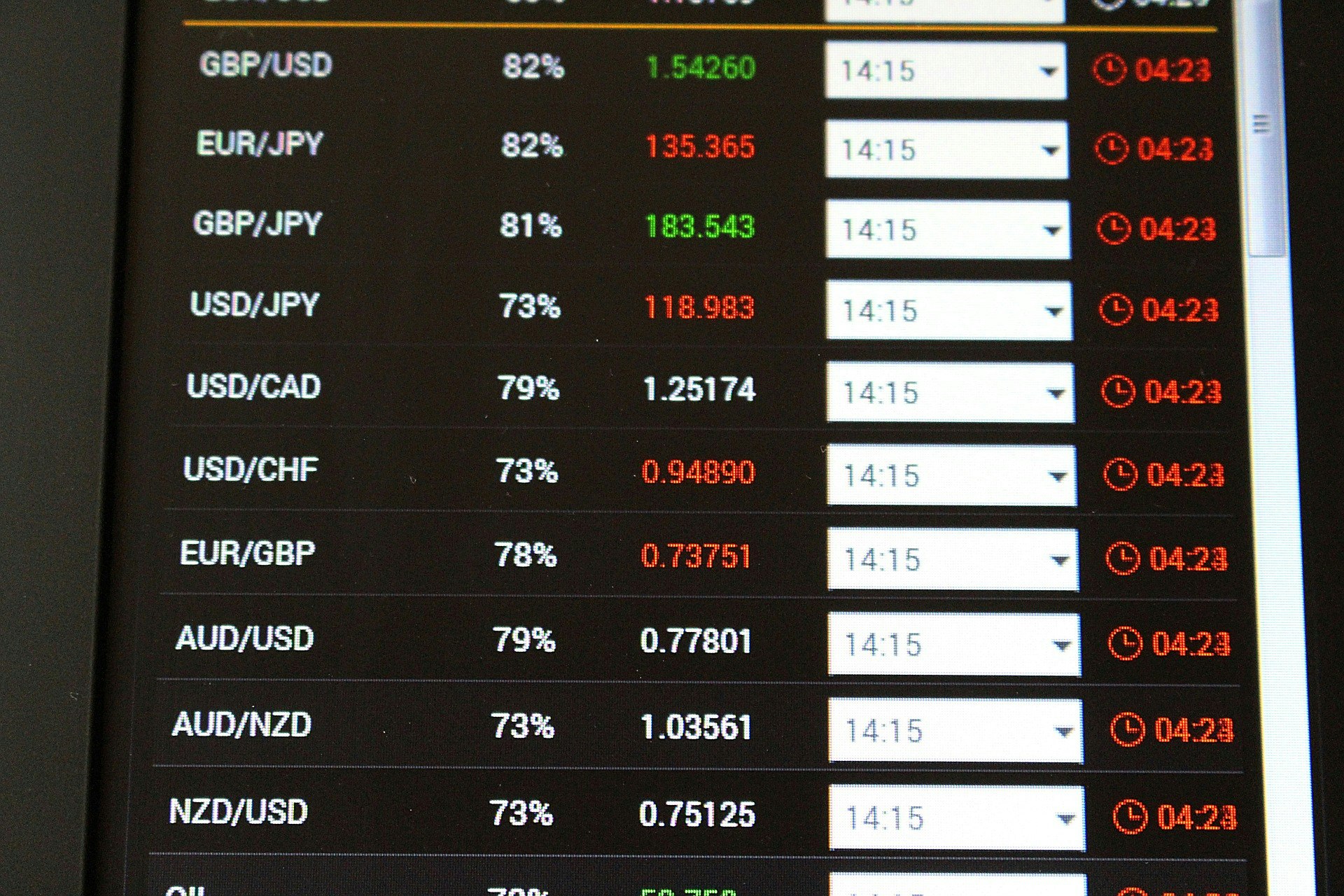

The Peak x Forex Currency Pairs

The Top x Forex Currency Pairs

Of the many currency combinations that you tin cull from, the following are the top 10 forex currency pairs:

1. EUR/USD

The Euro and the US dollar represent our two major economies globally, and as such, this is the most-ofttimes traded currency pair.

This major pair is highly liquid, and the linked exchange charge per unit is reliant on the European Central Bank, the US Federal Reserve involvement rates and NFP (non-subcontract payroll) announcements.

two. GBP/USD

This major pair is made up of the British pound and the United states dollar and consequently relies on how well the British and American economies are faring.

The linked exchange rate for this pair is reliant on interest rates set by the Bank of England and the US Federal Reserve.

One additional factor to monitor concerning this pair is the UK'south departure from the EU.

iii. USD/JPY

Made upwards of the US dollar and the Japanese yen, this major pair has high liquidity.

This is hardly surprising every bit the US dollar is the most traded currency globally and the Japanese yen is the most traded in the Asian market.

The substitution rate for this pair relies on involvement rates set by the The states Federal Reserve and the Depository financial institution of Japan. Other factors include the regularity of natural disasters in Nippon.

4. AUD/USD

Another major, this pair is made up of the Australian dollar and the US dollar.

Factors that affect this pair include the value of bolt exported by Commonwealth of australia such as fe ore, golden and coal, and the involvement rates ready by the Reserve Bank of Australia and the US Federal Reserve.

5. EUR/GBP

This is a minor pair because it does not include the US dollar. Information technology is made up of the Euro and the British pound.

The close link, geographically and due to strong merchandise arrangements between Europe and the U.k., makes this a hard pair to predict.

The sew together to the UK'due south difference from the EU has caused a highly volatile toll for EUR/GBP.

Farther factors to monitor include interest rates set by the Bank of England and the European Central Bank.

six. USD/CAD

This major pair includes the US dollar and the Canadian dollar.

Ane factor to monitor for this pair is Canada'due south reliance on the price of oil, its main export.

As the cost of oil rises, then too does the value of the Canadian dollar.

7. USD/CHF

This major pair, made upwardly of the United states dollar and the Swiss franc, is generally seen as a condom investment during times of economic and political turmoil.

Due to the popularity of this pair, there is a loftier level of information available and hence this pair has a high level of predictability.

8. NZD/CHF

This minor pair includes the New Zealand dollar and the Swiss franc.

New Zealand's increasing agronomical influence worldwide means that any trader looking to invest in this pair must monitor global agricultural product prices.

The price of this pair is also influenced by the Reserve Bank of New Zealand.

9. USD/CNY

This major pair is made upwardly of the United states dollar and the Chinese renminbi or yuan.

CNY, however, refers to the trading of this currency in the onshore Chinese trading market. When the Chinese renminbi or yuan is traded offshore, it is referred to as CNH.

The leading gene to monitor when investing in this pair is the US-People's republic of china trade war.

Historically, the value of the CNY has dropped against the US dollar due to the efforts of the Chinese regime to drive downwards the price of their exports.

ten. USD/HKD

This major pair, made upwardly of the United states dollar and the Hong Kong dollar, features a linked substitution rate that allows the HKD to motility within a band of HK$7.75/7.85 to one United states dollar.

Ane recent and important factor to monitor in relation to this pair is the ongoing situation in Hong Kong following the protests in that location in 2019.

Last Thoughts

The best forex pairs for you lot to trade will depend on many factors:

- What time of day y'all volition trade

- Whether y'all are interested in making a long-term investment to achieve larger profits or are happy to scalp smaller profits many times each twenty-four hours

- Your knowledge of currency, the forex markets and global economies

Trading forex pairs carries the opportunity to make a good for you profit, but information technology requires patience and regular research.

If you want to discover how three successful Forex traders made it big, read our article Can Yous Get Rich Trading Forex?.

WikiJob does non provide tax, investment, or financial services and advice. The data is existence presented without consideration of the investment objectives, risk tolerance, or financial circumstances of whatever specific investor and might not be suitable for all investors. By operation is not indicative of future results. Investing involves risk including the possible loss of principal.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether y'all can afford to have the high take chances of losing your money.

Source: https://www.wikijob.co.uk/content/trading/forex/top-forex-currency-pairs

Posted by: cannonquichishipt.blogspot.com

0 Response to "Best Forex Pairs To Trade"

Post a Comment