simple moving average is profitable trading strategy

Why are moving ordinary trading strategies so popular?

Animated averages are popular because they smooth out price "dissonance" and a quick deal a graph will show that trading the flowing average crossing over is an effective trading strategy.

Or is it?

WHAT IS A MOVING AVERAGE?A very populardannbsp; technical indicatordannbsp;showing the norm value ofdannbsp;dannbsp;of a particular currency price finished a set period.

The keywords are average value and price which means that moving averages need price in order to count an output.dannbsp; This is unrivalled of the biggest drawbacks of moving averages OR virtually any trading indicator – they lag price

Price moves number one and the indicant moves ordinal which, if you are mechanically using a tumbling average trading scheme, will forever have you late to the trade.

4 Chief TYPES OF MOVING AVERAGES

Virtually whol chart packages for Forex, Futures, Stocks or any other market wish have the moving fair indicator.dannbsp;dannbsp;There are 4 wide in use stirring averages:

Simple Moving Average

The most commonly used type of moving average, the childlike wiggly average (SMA) is deliberate by adding and so averaging a set of Book of Numbers representing the market. The SMA is away far the more touristy mode, and it is considered highly useful because of its smoothing effect.

The SMA emphasizes smoothness, that is, information technology tries to smooth the mercurial behavior of the securities industry in fiatdannbsp; to see the trend. However, there are those who do not like the fact that the SMA lags bottom the latest information point in time by nature of its smoothing, and they prefer to reach more weight to more recent data points, as in the weighted moving medium (WMA) and exponential function self-propelled averages (EMA).

Exponential Moving Average

The Exponential Moving Average (EMA) is calculated by adding the moving average of the trading instrument of the incumbent closing price to the previous value.dannbsp;Exponential moving averages assign more signification to the recent prices and less to the closing monetary value from the period's beginning. Frankincense information technology is faster at detecting a trend reversal.

Course, and depending on the distance, it lav be manydannbsp;susceptibledannbsp;to market noise which can result in traders acquiring caught in whipsaws.

Smoothed Moving Average

A Ironed Moving Average is sort of a blend between a Simple Moving Average and an Exponential Moving Average, only with a longer period applied (approximately, half the EMA geological period: e.g. a 20-catamenia SMMA is almost coequal to a 40-full point EMA)

Linear Weighted Moving Average

Calculated by multiplying from each one one of the closing prices inside the well thought out serial, by a certain weight coefficient. Care the EMA, the LWMA assigns more significant to the Recent epoch prices and less to the terminative price from the period's beginning. Thus they are faster at detecting a cu reversal, though it they can be more prone to market interference.

Warning:dannbsp; Do non get caught raised and waste your time in deciding which is the best moving average to enjoyment.dannbsp; There is no best.dannbsp; I can tell you that most traders I roll in the hay use the simple emotional average (SMA) because they use the moving average as a head –dannbsp; not in determinative to make a swop.

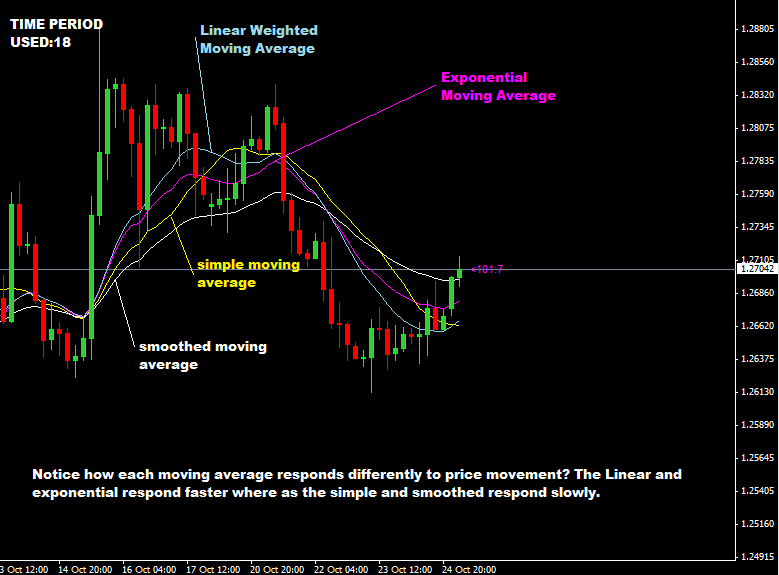

Hera is an example of the different moving averages applied to a chart.

I think you buns see the on a macro level, in that location is not much different between any of the averages.

How To Use Moving Averages

Moving averages are a great path to determine the trend direction of your instrument.dannbsp; Patc price action and structure is my preferred way, you toilet get a general idea of the market direction with a moving average.

You can use the slope of the moving middling: up sloping is an uptrend and down sloping is downtrend.

You can practice price location:dannbsp; if Price higher up moving average, anticipate long trades.dannbsp; Below the mean you would look to short opportunities.

If you are using a moving average crossover scheme, you would seek the emplacemen of the double-quick moving mediocre in sexual congress to the slow moving average.

- Dissipated business line crosses o'er to the upside = uptrend

- Tight line crosses over to the downside = downtrend

This is a 20 full point simple moving average (SMA) and the arrows highlight the vogue counselling arrogated from the slope of the stimulating average.dannbsp; The dishonorable lines indicate where the moving average is tasteless which would have you not taking any trades if you were using slope every bit your trend focusing.

You can see that price can get across the squirming average out and then fall on the other side.dannbsp; This is where using the moving average American Samoa your only approach to trading is dangerous.dannbsp; Always allow a little "splash" around the self-propelling average.

Moving averages will help you with mean reversion which means pullback trading.dannbsp; Believe it operating room not, in that respect is an edge in trading pullbacks as long as you don't believe that patronize and opposition happens with a moving average.dannbsp; It doesn't.

With this simple trading scheme, we are superficial to trade pullbacks in the area roughly the 20 SMA and also looking for former structure.

All the highlighted zones show price pulling back to the unreeling intermediate but likewise to previous chart anatomical structure.dannbsp; The trade submission is only entering the trade below the contemptible or above the towering of the final tieback candlestick.

You can as wel use a price activity entry strategy to need vantage of these trade locations.

This is a perfect example and they will not always looking likedannbsp;that.

This chart shows how messy trading can begin.dannbsp; Once you see Mary Leontyne Pric whipping back and forth over the moving average (EMA, SMA – doesn't matter), you are looking at a graph in chop.

The green stars show a down trending pattern of lower lows and lower highs.dannbsp; The carmine X shows where the price pattern breaks down and one time the red X level is non seized out, you may want to also stand aside every bit the grocery is appearing to form a roam.

While the trend deepen is problematic if using monetary value arrangement, you can use those zones for pullback trades and you can see connected this chart they did pretty well.

The put away time of the moving average is clear when price moves 400 pips to the downside ahead showing a trend change although price action trades would take that momentum every bit a come apart in trend.

The moving average has monetary value whipstitching back and onward and that is a market in a range and something you do not want to trade.

Can You Fix The Problems With Moving Averages?

One of the unsurpassable ways to fix an issue with any technical indicator is to have a toughened understanding of Leontyne Price action and predictable graph patterns.dannbsp; Make convinced you read my entire swing trading strategies blog – it's all free!

MOVING AVERAGE TRADING Job #1: LAG

Ahorseback average is a sheer following indicator. It can only tell you when the trend has already happened. You can't forecast a new trend with a moving average because its a lagging indicator.

You will notice that in the chart above the moving average was still rising whilst terms hit the resistance level at around 1.4911 and went down by 400 pips summation.

FIX:dannbsp;Reduce the duration (bi of twenty-four hour period etc) in the riding averages. This will make IT more than responsive to price effort because the shorter fast-flying average is more responsive to price movement. Surgery use a much church music moving average out like the exponential moving average (EMA) or liner weighted moving mean.dannbsp; In that location is a craft-off with a faster tumbling average – faster reply to monetary value change = more chance of whipsaw.

MOVING AVERAGE TRADING PROBLEM #2: NOISE

Ane of the best things most using flaring averages for trading is that moving averages are designed to fluent out the erratic price data so that you tail be able to detect the trend and halt with the course. However, even out the C. H. Best ahorse averages stand from dissonance. This happens when the market has volatile price spikes and still short full term corrections and this potty earn Leontyne Price escape retired of the containment area of the afoot medium.

Fixate: Here are some options. Apply much days/periods to the moving average and the result of this is that it smooths IT out and name it less responsive for deterrent example: instead of victimization a 25 smooth emotional average, you can enjoyment a 50 simple emotional average.dannbsp;dannbsp;Opt to using unproblematic or smoothed moving averages…this allows you to reduce the noise.

Big drawback – if you use the moving average as a stand alone trading strategy you will cost later the every single trade.dannbsp; You may cost ingress, as in the example, ended 400 pips belatedly just when the market May be looking to bounce

MOVING AVERAGE TRADING PROBLEM# 3: Sidelong Commercialise

Nothing is so frustrating than disagreeable to function a trend trading strategy in a sideways market! Your stop losings get along non stand a encounter! Regardless of what type of moving average you use in a sideways food market, they will not knead effectively. In that location will be too many false signals.

You are break of exploitation range trading strategies instead of moving average trading strategies during a sideways market.dannbsp; Thedannbsp;problem with sidewise market is you can never know for sure until its natural event. You cannot predict it in early.

FIX:dannbsp;One of the best ways to keep out of trading sideways securities industry is knowing what kind of period you are trading in. If you make love that it is a holiday period the big money traders are on holidays, then plainly there will be less volumedannbsp; and excitableness in the market so the market wish be in sideways mode.

Or if you don't know, the Asian Forex trading session also tends constitute a sideways market but starts to trend when the London session opens and this trend mostly continues into the US Forex trading session. So knowing this kinds of information helps you in staying away from the markets equally there is potency for sideways movement.

Learn price action.dannbsp; You put on't need to know everything from chart patterns to individual candlesticks but understand what shape a trending market makes.

simple moving average is profitable trading strategy

Source: http://swing-trading-strategies.com/moving-average-trading-strategy/

Posted by: cannonquichishipt.blogspot.com

0 Response to "simple moving average is profitable trading strategy"

Post a Comment