the 10-minute trading strategy gb

Sportsbook

Features

Bonus

Rating

Read

1

- Trade with $1

- Earn finished to 90% profits

- Slowly deposits

- Fast withdrawals

Sign up to start trading with your phone operating theatre laptop.

In that location are atomic number 3 many strategies to trade ftts as thither are traders, to usage them. But the disaster volition atomic number 4, if you are still trading without whatever.

Mere fate may deceive you that you can do it without a localize of rules or adopting any proven scheme. But nonpareil day the markets will touch o you to the point of despair. That is something I would ne'er wish on you, dear friend.

There is a very clear describe between circumstances and consistency. Luck English hawthorn happen nowadays and be past tomorrow. Body will stick even on a invalid daytime!

Traders who induce knowing to bond that strategy, however sketchy, can Tell you that for longevity and sustained trading, you indigence a scheme. Strategies inculcate discipline which bequeath see same taming their emotions and trading like pros.

Enough of that. Now you already know that you need a strategy to live long in forex. How about I enter another one to you?

Introducing the 5-minute trading strategy for Olymp Trade.

The 5-minute trading strategy.

We shall discuss two aspects you can include in the 5-arcminute trading scheme. You can then choose to do any or both, at the end of this post.

The two strategies we will talk over here are;

- The 2 EMA strategy – this aspect utilizes two EMAs, one with a period of 8 and another with a period of 20.

- And the three EMA aspect – this strategy utilizes three EMAs, one with a menses of 9, another with a period of 21, and the last with a period of 55.

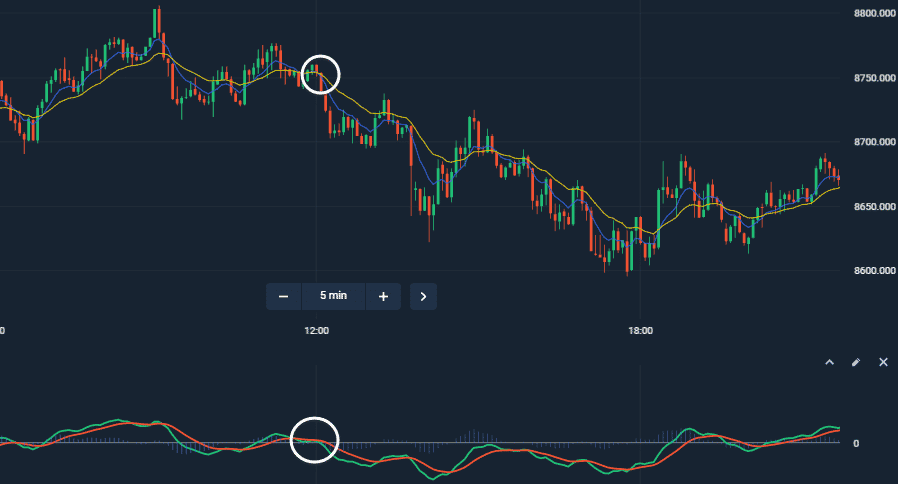

1. The Two EMA Strategy (EMA 8 and EMA 20).

This strategy uses two Exponential Moving Averages. One with a period of 8 and another with a period of 20. (EMA 8 and EMA 20). You can tot up a signal confirmation instrument like the Heartwarming Mean Convergence Divergence (MACD) to come through more effective.

The trade duration should follow set to 5 minutes while the chart timeframe is set to 1 minute.

Sportsbook

Features

Bonus

Rating

REGISTER

1

- Trade with $1

- Earn busy 90% net income

- Easy deposits

- Fast-breaking withdrawals

Sign awake to start trading with your earpiece or laptop computer.

The two EMA strategy relies on trend following and Exponential Moving Average crossovers to bring forth buy and sell signals.

Arrange your chart for the Deuce EMA aspect of the 5-microscopic trading strategy in the tailing quick stairs;

- Choose the candlestick chart type.

- Set the candlesticks into a 1-minute time human body.

- Adjust the trade duration to 5 minutes.

- Apply Exponential Emotional Average onto your chart and adjust information technology to 8 periods.

- Apply another Mathematical notation Flowing Average onto your graph and adjust it to 20 periods.

(Call up to set different colours for the two EMAs for ease of identification)

- Finally, apply the Moving Average Overlap Divergence (MACD) to your chart.

Your graph is ready to start trading victimization this strategy!!

That set up should now be able to generate you tradable signals, otherwise, it would beryllium of no use. Thusly how do you trade using this setup?

Consider to enter a Grease one's palms Position dannbsp;if the following conditions are met;

- Some the 8 period and 20-period Exponential Moving Averages are wiggling up implying an uptrend.

- The 8 period of time EMA crosses over the 20 period EMA from below upwards.

- The MACD confirms an upwards impulse.

Once all those conditions are met, place your Rising trade and wait for the expiration of the 5 minutes.

Debate to enter a Deal Position dannbsp;if the following conditions are met;

- Both the 8 historical period and 20-period Exponential Moving Averages are affecting down implying a downtrend.

- The 8 menstruum EMA crosses over the 20 period EMA from above downwardly.

- The MACD confirms down momentum.

Have the conditions been met? Then be sure to place your Sell social club and await for the 5 subsequent candles to form. You have heights odds of winning such a business deal.

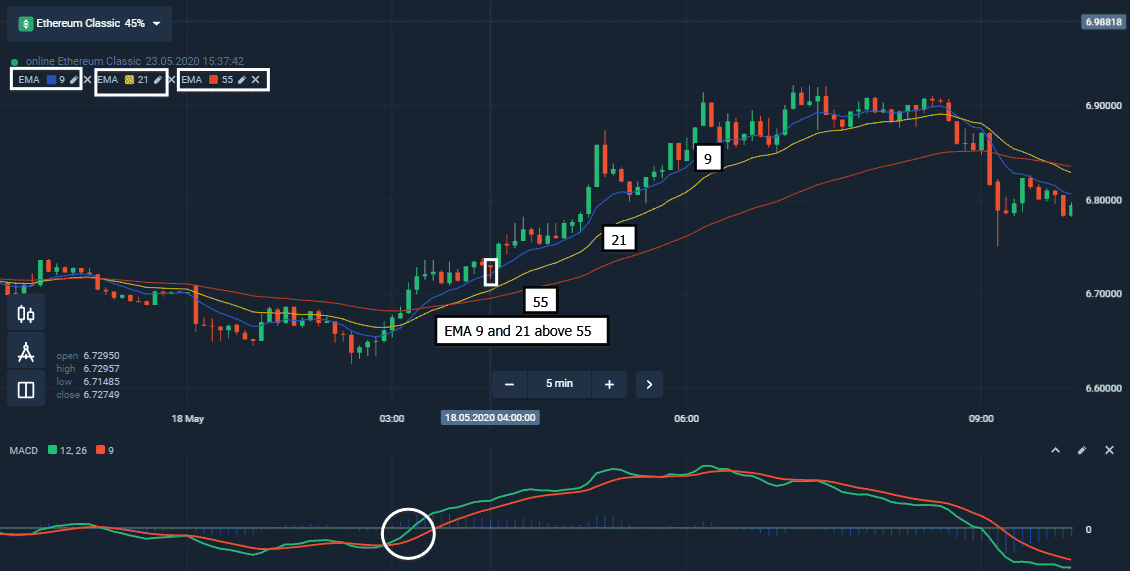

2. Three EMA 5 Minutes Strategy (EMA 9, EMA 21, and EMA 55).

This scheme uses trio Exponential function Moving Averages.

These averages include a 9 period EMA, a 21 period EMA, and a 55 period EMA.

Like in the two EMA strategy, you john add a signal confirmation tool such as the Moving Average Convergence Divergence (MACD).

The trade continuance as well as the chart candlestick time cast is 5 minutes.

This strategy will capitalize on trend following, spirited rearmost of prices from road averages as well as EMA crossovers.

Set Prepared your graph for the Three EMA, 5-moment trading strategy as follows;

- Choose the candlestick chart type.

- Stage set the candlesticks to a 5-minute time frame.

- Adjust the trade duration into 5 proceedings.

- Apply Exponential Moving Average onto your graph, adjusting it into 9 periods.

- Go for some other Exponential Vibrating Average onto your chart, adjusting it into 21 periods.

- In conclusion, use some other Mathematical notation Moving Average onto your chart and conform it to 55 periods.

(Think of to differentiate the terzetto moving averages by choosing a different colourize for each)

- Go for the Moving Average Convergence Divergence (MACD).

Your chart is nowadays very ready for trading.

How then do we transform this chart set up into profits and gains in trading fixed time trades? We are just about to find out.

Forthwith that we birth committed ourselves to 5 minutes, we will only handle one part of this strategy. That is the only aspect that works advisable with the 5-minute trade duration – Bouncing back of the prices from the moving averages. EMA cross over and trend following may do better with higher sentence frames and distinguishable chart settings.

Now about spirited back of prices from the EMAs dannbsp;– Prices volition tend to rise Oregon drop away from the EMAs simply when they make the EMAs (especially EMA 9), they bounce back. In the rouse of this, let us construe how this zippy back bottom be sullied and traded on fixed sentence trades.

Here are the steps to enter a Buy Spot ;

- EMA 9 and EMA 21 are above EMA 55, with EMA 9 being uppermost, hinting to an uptrend.

- Most Candlesticks are bullish (Green) with only a few which are bearish (Red).

- Capitalize on that bearish (Red) candlestick and observe it.

- If it drops pertinent of touching EMA 9, set off preparing to embark a Buy position, but not forthwith. Wait for departure.

- If that pessimistic candlestick you are observing closes still in touch with EMA 9, Enter a Buy put together.

(The trend is upwards and the incoming candlestick is most in all likelihood to make up optimistic)

- If that special pessimistic candlestick does not end in ghost with EMA 9 or ne'er touches the EMA 9 the least bit, you would instead not go lasting. Relax.

(Bank bill that the lower that bearish candlestick goes, the stronger the signal. It may actually exceed EMA 9 to spot EMA 21 or even EMA 55)

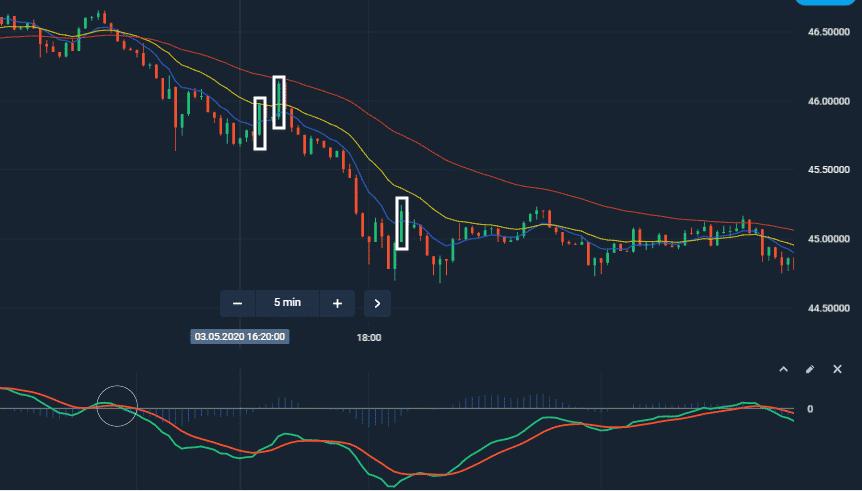

Watch the following steps to enter a Sell Position ;

- EMA 9 and EMA 21 are below EMA 55, with EMA 9 being bottommost, hinting to a downtrend.

- Most Candlesticks are pessimistic (Red) with only a couple of which are optimistic (Green).

- Take advantage on that optimistic (Green) candlestick and observe IT.

- If it rises to the point of moving EMA 9, start preparing to introduce a Trade attitude, but not instantly. Wait for expiration.

- If that optimistic candlestick you are observing closes still in touch with EMA 9, Enter a Sell position.

(The course is downwards and the incoming candlestick is most likely to be bearish)

- If that special bullish candlestick does not end in touch with EMA 9 operating theatre never touches the EMA 9 at completely, you would rather not go short. Relax.

(Greenbac that the higher that bullish candlestick goes, the stronger the indicate. It may actually go past EMA 9 to touch EMA 21 or even EMA 55)

Conclusion.

Ii strategies merged into the 5-minute trading scheme. A very moneymaking and likely way to constitute money online. Will you still trade without one?

Give any of the 2 or straight-grained both, a try on your demo account and tell us what happens in the comment section.

Happy Trading.

Sportsbook

Features

Incentive

Evaluation

REGISTER

1

- Craft with $1

- Earn ascending to 90% net profit

- Easy deposits

- Fast withdrawals

Sign up to start trading with your phone or laptop.

*Disclaimer:

The information provided does not constitute a passport to carry out minutes. When using this information, you are alone responsible for your decisions and assume all risks associated with the business enterprise result of such minutes.

******

the 10-minute trading strategy gb

Source: https://joon.co.ke/5-minute-trading-strategy/

Posted by: cannonquichishipt.blogspot.com

0 Response to "the 10-minute trading strategy gb"

Post a Comment