trading strategies with good percentage of probability

Very much of options traders consider a 90% probability strategy a Beatified Grail of trading. After completely, if you can win 90% of the time, you should be fit to mature your account very quickly, right? Well, not only this is not necessarily true, simply in fact, a winning ratio alone tells you zilch about your chances to embody profitable.

A winning ratio is simply a number of victorious trades divided by the total number of trades. E.g., a trader who won 15 out of 20 trades would have a 75% winning ratio. A 90% winning ratio strategy in options ordinarily refers to Out Of The Money credit spreads that have 90% probability to expire unworthy. To accomplish a 90% probability, you have to sell credit spreads with short deltas roughly 10.

Options Delta can be viewed as a portion probability that an option will wind astir in-the-money at expiration. Looking at the Delta of a furthest-unsuccessful-of-the-money option is a good indication of its likelihood of having time value at termination. An choice with to a lesser extent than a .10 Delta (Beaver State less than a 10% probability of being in-the-money) is not viewed as very likely to be in-the-money at any guide and will postulate a strong move from the underlying to have value at expiration.

When you deal out a credit spread with light deltas around 10, they bear approximately 90% probability to expire worthless. Thusly theoretically, you have a chance to throw a 90% fetching ratio.

Hither is the problem: when you have a 90% probability trade, your risk/reward is terrible - usually around 1:9, meaning that you risk $9 to make $1. Also with 90% probability trades, your supreme hit is commonly limited to 8-10%, but your loss can follow 100%. That means that you can have a 90% winning ratio, and still lose money. Also consider the fact that if you deliver the goods 10% quintuplet times in a row and so lose 50%, you are not breakeven. You are actually down 25%.

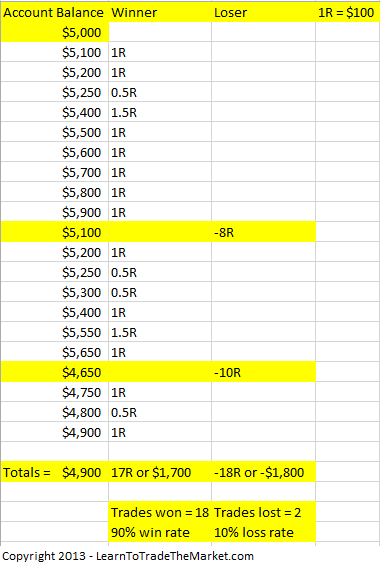

In the example fancy below, we john see that flatbottomed with a 90% taking percentage, a trader dismiss still lose money if they take losses that are too large relative to their winners:

It should atomic number 4 obvious by forthwith that a winning ratio alone doesn't tell the whole story - in fact, IT is pretty meaningless.

Does it mean that credit spreads are a bad strategy? Non at all. But considering a winning ratio alone to evaluate a strategy is not a wise thing to do.

On the other side of the spectrum are traders who completely dismiss credit spreads attributable their terrible risk/reward ratio. Here is an draw out from an article past an options Guru:

The truth is that OTM Credit Spreads get a high-altitude probability of making a earnings. The average Credit Spread trader will face 100% losses on this trade several times a year while trying to establish a modest 5 to 10% a month. What happens is that eventually most Credit Spread Traders converge their doomsday. One of these days, most every last option traders WHO use only OTM Cite Spreads wipe out their trading accounts.

Let's deal the "Computer Bug" of 2010 when the DOW dropped 1000 points in a matter of minutes. Those doing Credit Spreads on this day perplexed on middling between 70% and 90% of their portfolio. What happened is that the excitability rose drastically and the trades moved into that "danger zone" where they lose 100% 10 percent of the time. The Recognition Spread trader doesn't realize that the 10 per centum of the time they lose can pass off AT ANY TIME. Well-nig masses suppose that they will have 9 wins followed away 1 loss, but this obviously is non how the law of chance works. IT's not uncommon for an OTM Credit Spread trader to face a harmful loss on their very first trade, and in one case this happens, at that place is no way to recover since a winning trade will exclusively bring spinal column 10% on the remaining capital."

While I agree that citation spreads are much riskier than most traders believe, the clause ignores some important factors. IT is true that credit spreads can experience extraordinary same significant losses from time to clip. Only this is where position sizing comes into play. Personally, I would ne'er place more than 15-20% of my options account into credit spreads - unless they are hedged with put debit spreads and/or puts.

Overall, credit spreads and other high probability strategies posterior and should be part of a well-diversified options portfolio, but traders should dressed ore on managing the strategy and the risk of exposure, and not on the fetching ratio. In fact, many job traders consider a 60% winning ratio excellent. For example, St. Peter the Apostl Willy Brandt admits that his winning ratio is exclusively 43% - yet his Audited annual ROR is 41.6%. Many strategies are designed to have few big winners and some small losers.

The bottom product line: the only thing that matters in trading is your gross portfolio return. A winning ratio simply doesn't tell the whole story.

This clause was written by

Kim Klaiman is a full time options dealer and founder of SteadyOptions.com. Helium trades mostly non-position strategies, like pre-earnings strangles and iron condors. Kim likes to trade strategies with pessimistic correlation. He lives in Toronto, Canada. Gossip the SteadyOptions.com assembly. SteadyOptions offers a combining of a superiority Department of Education and unjust trade ideas using variety show of Non-Directional option trading strategies for Steady and Consistent Profits. Electronic mail: info@steadyoptions.com Keep an eye on me on Chirrup: https://chitter.com/SteadyOptions_ SteadyOptions performance: https://steadyoptions.com/performance

Disclosure: I/we have no positions in some stocks mentioned, and no plans to broach any positions inside the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving recompense for it. I have no business relationship with any company whose stock is mentioned in this clause.

trading strategies with good percentage of probability

Source: https://seekingalpha.com/article/4221132-is-90-percent-probability-strategy-holy-grail

Posted by: cannonquichishipt.blogspot.com

0 Response to "trading strategies with good percentage of probability"

Post a Comment