How Much Do You Make Trading Binary Options

At present that we have a bones thought on how binary selection trades work, let's take a wait at a simple example.

Let'south say, you decide to merchandise EUR/USD with the supposition that price volition rise.

The pair's current price is i.3000, and you believe that afterwards one hr, EUR/USD will be higher than that level.

You then await at your trading platform and come across that the banker's payout is 79% on a one hour choice contract with a target strike of 1.3000.

After much deliberation, you finally decide to buy a "call" (or "up") option and run a risk a $100.00 premium.

Yous could say it'south similar to going "long" on EUR/USD on the spot forex market.

| Ending Scenarios After Entering a CALL Option | Gain/Loss |

|---|---|

| Expiry cost is in a higher place the strike toll (in-the-money) | $100.00 x 79% = $79 $100.00 + $79.00 = $179.00 Y'all gain $179.00 on your account. |

| Decease toll is equal to or below the strike price (out-of-the-money) | Y'all lose your stake and your account declines past $100.00. |

As you tin see from the calculations above, the adventure you have is express to the premium paid on the option.

You cannot lose more than your stake. Unlike in spot forex trading, where your losses can go bigger the farther the merchandise goes confronting you lot (which is why using stops are crucial), the take chances in binary options trading is admittedly limited.

Payouts in Binary Options

Now that we've looked at the mechanics of a simple binary trade, nosotros recall information technology's high time for you to larn how payouts are calculated.

More often than not, the payout will exist determined past the size of your upper-case letter at risk per trade, whether you're in- or out-of-the-coin when the merchandise is closed, the type of option trade, and your broker'due south commission rate.

In the example given in a higher place, y'all bet $100 that EUR/USD volition close above 1.3000 after an hour with your broker offering a 79% payout charge per unit. Let'due south say that your assay was spot on and your trade ends upwards being in-the-money. You would and then get a payout of $179.

$100 (your initial investment) + $79 (79% of your initial capital) = $179

Easy peasy, correct? Don't go too excited just yet! Y'all should know that there's no one-size-fits-all formula for computing payouts. In that location are a few other factors that touch on them.

Factors in Payout Calculations

Each banker has its own payout rate. For starters, Forex Ninja's intel shows that most brokers offer somewhere between 70% and 75% for the well-nigh basic pick plays while at that place are those who offer equally low at 65%.

Various factors come into play when determining the percentage payout.

The underlying asset traded and the time to expiration are a couple of big components to the equation.

Ordinarily, a market that is relatively less volatile and an expiration fourth dimension that is longer usually means a lower percentage payout.

Next, the broker's "committee" is too factored into the payout rate. After all, brokers are providing a service for you, the trader, to play out your ideas in the market so they should be compensated for it.

The commission rate does vary widely among brokers, just since there are then many binary options brokers out there (and more coming forth), the rates should go increasingly competitive over fourth dimension.

When a Binary Choice Merchandise is Closed

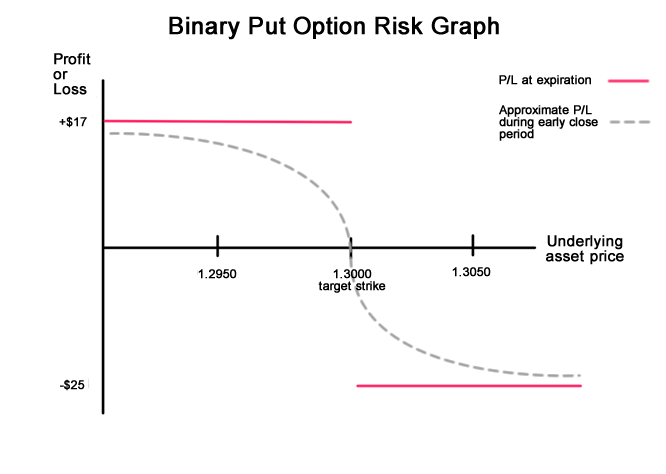

As mentioned before, binary options are typically "all-or-cypher" trading instruments in that the payout or loss is simply given at contract expiration, but there are a few brokers that let you to close a binary choice trade ahead of expiration.

This usually depends on the type of choice, and usually it's just available within a certain timeframe (e.g., bachelor 5 minutes later on an option trade opens, upwardly until 5 minutes before an option expiration).

The merchandise-off for this flexible feature is that brokers who do allow early trade closure tend to have lower payout rates.

When trading with a binary option broker that allows early closure of an option trade, the value of the selection tends to move along with the value of the underlying asset.

For example, with a "put" (or "down") selection play, the value of the choice contract increases as the market place moves below the target (strike) price.

This means that, depending on how far it has moved passed the strike, the closing value of the option may be more than the risk premium paid (simply never greater than the agreed maximum payout).

Conversely, if the underlying market moved higher, further out-of-the-money, the value of the pick contract decreases and the choice heir-apparent would be returned much less than the premium paid if he/she closed early.

Of class, in both cases, the broker commission is factored into the payout of an pick trade when closed early on.

So earlier you make up one's mind to jump head get-go into trading binary options, make certain yous do your inquiry and find out what your banker's payout rates and conditions are!

How Much Do You Make Trading Binary Options,

Source: https://www.hsb.co.id/learn/forex/how-to-make-money-trading-binary-options.html

Posted by: cannonquichishipt.blogspot.com

0 Response to "How Much Do You Make Trading Binary Options"

Post a Comment